India’s urban FMCG market continued its steady climb in 2025, with value growth of 11.5% year on year — one of the highest in Asia, states the Q3 2025 edition of the Asia Pulse report by Worldpanel by Numerator, a leading global market research firm. Volume growth reached 4.7%, slightly ahead of last year’s 4.5%, reflecting consistent consumer engagement despite rising inflationary pressure.

However, inflation has begun reshaping buying patterns. Shoppers are becoming more cautious, especially in snacking and personal care, where the number of shopping occasions has declined slightly. Consumers are breaking purchases into smaller baskets, a sign of tighter budgets or a desire for convenience, the report said.

The Asia Pulse report used to be released by Kantar. However, earlier this year, Numerator and Kantar Worldpanel combined to form a new global consumer data company called Worldpanel by Numerator.

“Urban FMCG recorded volume growth of 4.7% in Q3, slightly above the previous year’s 4.5% rise. While growth persists, rising inflation appears to be driving more cautious spending, influencing overall consumption. This shift is most visible in categories such as snacking and personal care, where shopping occasions are slightly declining,” the report seen by IndiFoodBev said.

Within categories, beverages have lost momentum. After an 11% surge in 2024, growth has cooled sharply — milk-based drinks dropped from +3% to a –9% decline, and bottled soft drinks slowed from +16% to just +0.4%.

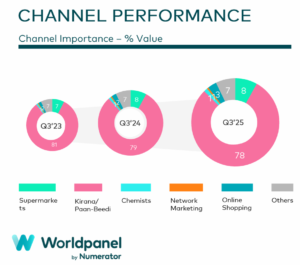

In terms of shopping channels, kirana or neighborhood stores remain dominant but are slowly losing share to modern and online retail. Online shopping surged in both frequency and reach, reflecting how digital platforms are gaining ground as consumers seek value and accessibility. Supermarkets and chemists have maintained a stable share, indicating their continued relevance in providing daily essentials.

Overall, India’s urban FMCG sector shows a story of resilience and adaptation — growth continues, but shoppers are balancing inflation with smarter, smaller, and more digital buying habits.

Asia’s FMCG outlook

Amidst ongoing global uncertainty and cautious consumer sentiment, Asia’s FMCG sector experienced a modest uptick in Q3 2025, with value sales increasing 2.4% year-over-year. Food sector maintained resilience, and beverages posted moderate gains, while dairy continued to struggle. Household and personal care sustained a steady performance.

North Asia registered a 1.6% increase in value sales, sustaining its pattern of subdued growth. Southeast Asia expanded by 2.3%, reflecting a slight slowdown compared to the previous quarter. South and West Asia remained the strongest performer with 6.6% growth, largely attributable to India’s significant contribution.

This report examined consumer trends across 11 Asian markets, highlighting shifts in spending, evolving category preferences, and emerging opportunities.

In the first three quarters of 2025, China‘s FMCG market maintained a stable upward trend. Across the five major categories, beverages continued to lead sales growth, while dairy still faced significant challenges due to declines in both purchase frequency and spend per trip.

IndiFoodBev — authentic, impactful and influential

An English-language food and beverage processing and packaging industry B2B platform in print and web, IndiFoodBev is in its third year of publication. It is said that the Indian food and beverage industries represent approximately US$ 900 billion in revenues which implies more than 20% of the country’s GDP. Eliminating the wastage on the farmside can help to deliver more protein to a higher number of the population apart from generating sizable exports. The savings in soil, seeds, water, fertilizer, energy and ultimately food and nutrition could be the most immense contribution that country is poised to make to the moderation of climate change.

To improve your marketing and grow sales to the food and beverage processing and packaging industry, talk to us. Our research and consulting company IppStar [www.ippstar.org] can assess your potential and addressable markets in light of the competition. We can discuss marketing, communication, and sales strategies for market entry and growth.

Suppliers and service providers with a strategy and budget for targeted marketing can discuss using our hybrid print, web, video, and social media channels to create brand recognition linked to market relevance. Our technical writers are ready to meet you and your customers for content.

The second largest producer of fruit and vegetables in the world is continuously expanding processing capacities and delivery systems with appropriate innovative technologies. We cover product and consumer trends, nutrition, processing, research, equipment and packaging from farm to thali. Get our 2025 media kit and recalibrate your role in this dynamic market. Enhance your visibility and relevance to existing markets and turn potential customers into conversations. Ask for a sample copy of our bi-monthly in print or our weekly IndiFoodBev eZine each Wednesday.

For editorial info@ippgroup.in — for advertisement ads1@ippgroup.in and for subscriptions subscription@ippgroup.in

Naresh Khanna – 10 February 2025

Subscribe Now