The recently released annual ‘Statistical Report on Value of Output from Agriculture and Allied Sectors (2011-12 to 2023-24)’ throws light on some interesting aspects of the changing face of Indian agricultural trends and consumption habits in India. The data from the National Statistics Office (NSO), Ministry of statistics and programme implementation (MoSPI), records the gross value of output (GVO) as well as the gross value added (GVA) of the agricultural and allied food sectors.

While GVO measures production by referring to the total value of items produced before subtracting the costs of inputs used in production, GVA is the measure of the value of goods and services produced in an area, industry or sector of an economy.

Agriculture GVA up but share declines

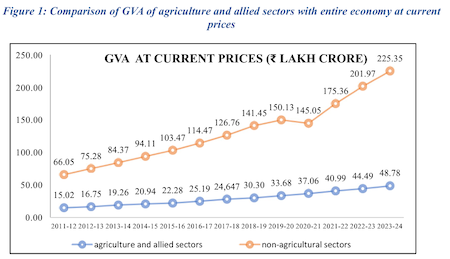

According to the report, the GVA of agriculture and allied sectors at current prices showed a 225% growth over twelve years, increasing from ₹15.02 lakh crore (US$178.81 million) in 2011-12 to ₹48.78 lakh crore (US$580.71 million) in 2023-24.

However, their share in the total GVA declined by 18.5% from FY 2011-12 to 17.8% in FY 2023-24 due to a faster growth in non-agricultural sectors. According to the report, this trend underscores the need to modernize and diversify agriculture to ensure rural growth keeps pace with broader economic progress.

The overall GVA for the Indian economy, it may be mentioned, increased over threefold from ₹81.07 lakh crore (US$965.12 million) in FY 2011-12 to ₹274.13 lakh crore (US$ 3,263.45 million) in FY 2023-24 at current prices.

At the same time, the GVO and the overall agriculture output from these sectors at constant prices also showed a steady growth from ₹19.08 lakh crore (US$227.14 million) in FY 2011-12 to ₹29.49 lakh crore (US$351.07 million) in FY 2023-24 – an overall increase of approximately 54.6%.

The report contains detailed tables on the values of output from the crop, livestock, forestry and logging, and fishing and aquaculture sectors from FY 2011-12 to FY 2023-24 at current and constant (2011-12) prices.

The crop sector was the largest contributor to overall agriculture output with a GVO of ₹15.95 lakh crore (US$189.88 million), even though its share declined from 62.4% to 54.1%. Cereals and fruits & vegetables together accounted for 52.5% of total crop GVO in FY 2023-24.

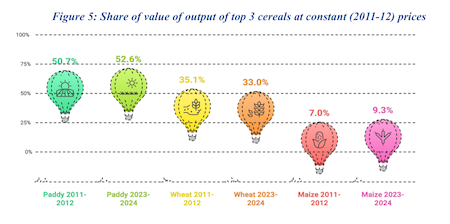

The total GVO of cereals increased from ₹3.36 lakh crore (US$40 million) in FY 2011-12 to ₹4.27 lakh crore (US$50.83 million) in FY 2023-24, reflecting the continued importance of cereals in Indian agriculture. However, within this group, the relative contribution of individual cereals shifted notably over time.

Paddy’s share grew by 2% while that of wheat fell by the same margin in FY 2023-24 as compared to 2011-12. Maize’s share rose from 7.0% to 9.3% while the contribution of millets such as bajra and jowar to total cereal GVO reduced over the years despite minor fluctuations in their absolute value.

Among cereals, paddy and wheat topped the list, contributing approximately 85% of the GVO (at constant prices) for all cereals in FY 2023-24.

Uttar Pradesh, Madhya Pradesh, Punjab, Telangana, and Haryana contributed nearly 53% of the GVO (at constant prices) of cereals in 2023-24. Although Uttar Pradesh saw a reduced share (from 18.6% in 2011-12 to 17.2% in 2023-24), it remained the leading contributor.

The total GVO of pulses rose from ₹0.52 lakh crore (US$6.19 million) in FY 2011-12 to ₹0.74 lakh crore (US$ 8.81 million) in FY 2023-24, reflecting both production increase and a growing price trend. In pulses, gram and arhar together accounted for over 58% of the value of output in FY 2023-24. Gram’s standalone share was 43%. Madhya Pradesh, with a 22.5% share in GVO in FY 2023-24, maintained its top position in pulses production.

The report says that in crop production, there has been a noticeable shift toward crop diversification, along with increased adoption of high-yielding and genetically modified varieties of seeds aimed at boosting productivity and resilience against climate change.

Fruits and vegetables

There has been a steady growth in the output of fruits & vegetables from ₹2.70 lakh crore (US$ 32.14 million) in FY 2011-12 to ₹4.10 lakh crore (US$48.81 million) in FY 2023-24 at constant (2011-12) prices. Though the share of vegetables decreased marginally from 56.5% to 55.0%, it remained the major contributor in this group.

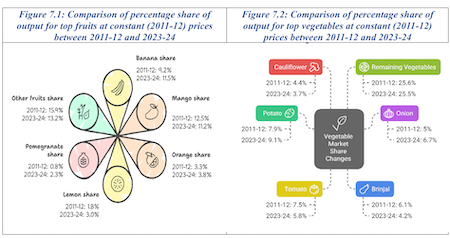

Among other trends, the data indicates a spike in the GVO of generally considered high-end fruits such as strawberries and pomegranates as well as vegetables such as parwal (pointed gourd), which is considered not so popular, and mushrooms, thought to have a niche audience, over the last decade.

Strawberry production soared more than 40 times from 2011-12 to FY 2023-24, increasing from a GVO of ₹1.32 crore (USD 0.16 million) to ₹55.4 crore (US$6.60 million) (at constant prices). Without adjusting for inflation, the GVO of strawberries rose almost 80 times to ₹103.27 crore (US$12.29 million).

The GVO of parwal increased nearly 17 times to ₹789 crore (US$93.93 million) and that of pumpkin, another underrated veggie, by nearly 10 times to ₹2,449 crore (US$291.55 million). Pomegranate’s GVO increased over four times to ₹9,231 crore (US$1,098.93 million) and mushrooms rose 3.5 times to ₹1,704 crore (US$202.86 million).

Other fruits showing substantial GVO growth include watermelon (119%), cherries (99%), bananas and mosambi (both 88%), and muskmelon (87%).

Bananas topped in 2023-24 with its GVO (₹47,000 crore or US$5,595.24 million)) beating the king of fruits, mango (₹46,100 crore or US$5,488.10 million)), by a whisker compared to FY 2011-21. Mangoes, however, performed consistently, being the top contributor in GVO (at constant prices) in the fruits category from FY 2011-12 to FY 2021-22.

Among vegetables, potato was the leading contributor (at constant prices) from FY 2011-12 to FY 2023-24, with its GVO increasing from ₹0.21 lakh crore (US$2.5 million) in FY 2011-12 to ₹0.37 lakh crore (US$4.40 million) in FY 2023-24.

Floriculture nearly doubled from ₹0.17 lakh crore (US$2.02 million) in FY 2011-12 to ₹0.28 lakh crore (US$3.33 million) in FY 2023-24 at constant prices, reflecting rising commercial interests and diversification in horticulture.

The output of ‘condiments & spices’ doubled, rising from ₹0.46 lakh crore (US$5.48 million) in FY 2011-12 to ₹0.95 lakh crore (US$11.31 million) in FY 2023-24 at constant (2011-12) prices. Madhya Pradesh’s share in the GVO of condiments and spices rose to 19.2% in FY 2023-24, making it the top contributor in this category, followed by Karnataka and Gujarat, with shares of 16.6% and 15.5%, respectively.

Livestock and fishery

The GVO of livestock products increased from ₹4.88 lakh crore (US$58.10 million) in FY 2011-12 to ₹9.19 lakh crore (US$109.40 million) in FY 2023-24, making it one of the fastest-growing segments of agriculture and allied activities. Although milk remained dominant, its share fell from 67.2% to 65.9% between FY 2011-12 and FY 2023-24.

Conversely, the share of the meat group in the total GVO of the livestock sector rose from 19.7% to 24.1% during the same period (at constant prices). Eggs contributed around 4% of the total value of output of the livestock sector.

The contribution of the fishing and aquaculture sub-sector to agricultural GVA increased from 4.2% in FY 2011-12 to 7.0% in FY 2023-24. Displaying an ever-increasing trend, the sector’s GVO more than doubled from FY 2011-12 (₹0.80 lakh crore or US$9.52 million) to FY 2023-24 (₹2.07 lakh crore or US$24.64 million).

The output value of inland fish increased twofold from ₹0.46 lakh crore (US$5.48 million) in 2011-12 to ₹1.04 lakh crore (US$12.38 million) in 2023-24, while that of marine fish tripled in the same period. The share of inland fish, however, declined from 57.7% to 50.2%, while that of marine fish rose from 42.3% to 49.8% during the same period.

Andhra Pradesh dominated the sector in 2023-24 with a 39.1% share in the total GVO at the all-India level. West Bengal was the highest contributor with a 24.6% share in 2011-12.

This sub-sector has seen growing investments in infrastructure, such as cold chains and veterinary services, which have improved animal health and product quality, the report said.

IndiFoodBev — authentic, impactful and influential

An English-language food and beverage processing and packaging industry B2B platform in print and web, IndiFoodBev is in its third year of publication. It is said that the Indian food and beverage industries represent approximately US$ 900 billion in revenues which implies more than 20% of the country’s GDP. Eliminating the wastage on the farmside can help to deliver more protein to a higher number of the population apart from generating sizable exports. The savings in soil, seeds, water, fertilizer, energy and ultimately food and nutrition could be the most immense contribution that country is poised to make to the moderation of climate change.

To improve your marketing and grow sales to the food and beverage processing and packaging industry, talk to us. Our research and consulting company IppStar [www.ippstar.org] can assess your potential and addressable markets in light of the competition. We can discuss marketing, communication, and sales strategies for market entry and growth.

Suppliers and service providers with a strategy and budget for targeted marketing can discuss using our hybrid print, web, video, and social media channels to create brand recognition linked to market relevance. Our technical writers are ready to meet you and your customers for content.

The second largest producer of fruit and vegetables in the world is continuously expanding processing capacities and delivery systems with appropriate innovative technologies. We cover product and consumer trends, nutrition, processing, research, equipment and packaging from farm to thali. Get our 2025 media kit and recalibrate your role in this dynamic market. Enhance your visibility and relevance to existing markets and turn potential customers into conversations. Ask for a sample copy of our bi-monthly in print or our weekly IndiFoodBev eZine each Wednesday.

For editorial info@ippgroup.in — for advertisement ads1@ippgroup.in and for subscriptions subscription@ippgroup.in

Naresh Khanna – 10 February 2025

Subscribe Now