At the 10th Injection, Blow Moulding and PET International Business Summit in Mumbai, Allied Blenders and Distillers (ABD) made a case for the adoption of PET bottles as a sustainable packaging solution in the alcoholic beverages sector.

Delivering a presentation at the event, Mohit Marwah, lead – blending and quality at ABD, said the company sold 33 million 9-liter cases of spirits last year across India and 22 export markets. ABD, the largest Indian spirits company by volume, operates 34 manufacturing sites, including two distilleries that produce its own extra-neutral alcohol (ENA).

Marwah argued that PET packaging offers a compelling alternative to glass, particularly from an environmental, social and economic sustainability perspective. “Sustainability has evolved from a niche concept to a mainstream necessity. In packaging, it’s no longer optional—it’s a must,” he said.

He noted that glass, while offering a premium image, recyclability, and chemical inertness, also has significant drawbacks—heavy, fragile, expensive to manufacture, and costly to transport. PET is lightweight, durable, 100% recyclable, and far more convenient for both producers and consumers.

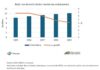

Citing global packaging trends, he said 70% of major beer and spirits brands are now adopting sustainable packaging options, up from 40% in 2018. For spirits alone, sustainable packaging adoption has more than doubled—from 15% in 2020 to 35% now.

“Even premium brands have started shifting to PET, breaking the long-held perception that plastic bottles are only for low-end products,” Marwah said, citing ABD’s own Sterling Reserve as an example. He said the RTD (ready-to-drink) segment is particularly active in adopting PET.

In India, the shift is evident. From just 4.2% in FY21, PET’s share in alcohol packaging has grown to 15-16%, with several states now seeing over 20% of spirits packed in PET. “PET packaging in spirits is growing at 8-10% annually,” Marwah noted, citing favorable trends in Southeast Asia, Latin America, and parts of Africa where PET is widely accepted due to affordability and ease of transport.

On sustainability metrics, a 750ml PET bottle weighs just 40g, compared to 450-500g for its glass counterpart. PET generates over 50% less carbon emission and, across its lifecycle, leaves only a tenth of the carbon footprint of glass. It also supports circular economy models by creating jobs in plastic collection and recycling.

However, regulatory hurdles remain. PET alcohol packaging is not permitted in defense canteens and certain states such as Odisha and Chhattisgarh, Marwah noted. He welcomed Rajasthan’s recent approval of PET for alcohol packaging but pointed out a lack of clarity on reuse regulations for rigid bottles over 0.9 liters and limited availability of cost-effective rPET (recycled PET).

Marwah concluded by emphasizing that the full benefit of PET can only be realized with robust collection and recycling infrastructure. “A PET bottle is truly sustainable only if it is recycled. Without an effective recycling system, we risk turning a solution into another problem,” he said.

IndiFoodBev — authentic, impactful and influential

An English-language food and beverage processing and packaging industry B2B platform in print and web, IndiFoodBev is in its third year of publication. It is said that the Indian food and beverage industries represent approximately US$ 900 billion in revenues which implies more than 20% of the country’s GDP. Eliminating the wastage on the farmside can help to deliver more protein to a higher number of the population apart from generating sizable exports. The savings in soil, seeds, water, fertilizer, energy and ultimately food and nutrition could be the most immense contribution that country is poised to make to the moderation of climate change.

To improve your marketing and grow sales to the food and beverage processing and packaging industry, talk to us. Our research and consulting company IppStar [www.ippstar.org] can assess your potential and addressable markets in light of the competition. We can discuss marketing, communication, and sales strategies for market entry and growth.

Suppliers and service providers with a strategy and budget for targeted marketing can discuss using our hybrid print, web, video, and social media channels to create brand recognition linked to market relevance. Our technical writers are ready to meet you and your customers for content.

The second largest producer of fruit and vegetables in the world is continuously expanding processing capacities and delivery systems with appropriate innovative technologies. We cover product and consumer trends, nutrition, processing, research, equipment and packaging from farm to thali. Get our 2025 media kit and recalibrate your role in this dynamic market. Enhance your visibility and relevance to existing markets and turn potential customers into conversations. Ask for a sample copy of our bi-monthly in print or our weekly IndiFoodBev eZine each Wednesday.

For editorial info@ippgroup.in — for advertisement ads1@ippgroup.in and for subscriptions subscription@ippgroup.in

Naresh Khanna – 10 February 2025

Subscribe Now