Pointing to the rising potential of the food processing sector, the Economic Survey 2023-24 says the share of processed food exports increased from 14.9% in 2017-18 to 23.4% in 2022-23. The value of agri-food exports, including processed food exports during 2022-23, stood at US$46.44 billion, accounting for about 11.7% of India’s total exports.

The food processing industry in India is one of the largest employers in organized manufacturing, with a 12.02% share in the total employment in the organized sector, the survey said, quoting ministry of food processing (MoFPI) data.

“India is the largest producer of milk and the second largest producer of fruits, vegetables, and sugar. The availability of reasonably priced agricultural inputs, the vast labor force, and continuously growing consumer demand provide the essential elements for a robust food processing industry. The sector also plays a vital role in reducing the wastage of perishable agricultural produce, enhancing the shelf life of food products, ensuring value addition to agricultural produce, and incentivizing diversification & commercialization of agriculture,” the survey says.

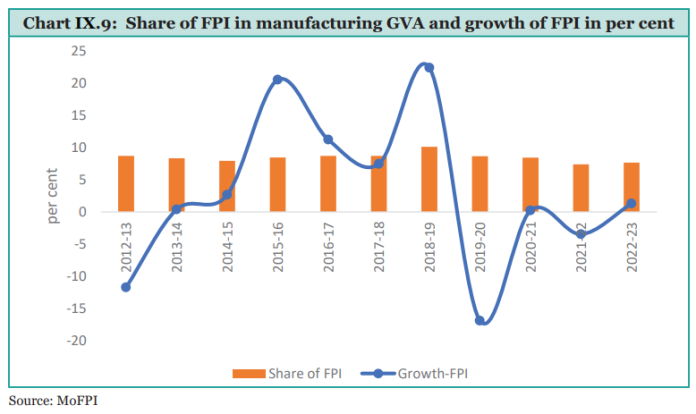

According to the survey, food processing is an important industry because it is strongly linked to agriculture and can employ a surplus workforce released from the agriculture sector. During the last eight years ending 2022-23, the food processing industry has grown at an average annual growth rate (AAGR) of around 5.35% at 2011-12 prices. Being labor-intensive, the pandemic adversely affected the sector and is now recovering.

The gross value added (GVA) in the food processing sector has increased from ₹1.30 lakh crore in 2013-14 to ₹1.92 lakh crore in 2022-23. The sector constituted 7.66% of GVA in manufacturing in 2022-23 at 2011-12 prices. GVA is a productivity metric that measures the contribution of a corporate subsidiary, company, or municipality to an economy. In other words, it is the measure of the value of goods and services produced in an area, industry or sector of an economy.

The government has taken initiatives to improve the supply chain management from farm gates to retail outlets. The production-linked incentive scheme for the food processing industry (PLISFPI) supports the creation of global food manufacturing champions, branding and marketing abroad, according to the report. It is expected to create off-farm employment and provide better prices for farm produce and higher income to farmers. At present, 173 applications are covered under the PLI Scheme. The beneficiaries of the scheme have invested ₹76,900 crore. An incentive amount to the tune of ₹1,070 crore was released in FY 2021-22 and FY 2022-23.

The PM Formalization of Micro Food Processing Enterprises (PMFME) scheme with a total outlay of ₹10,000 crore provides credit-linked subsidy and capacity building, including marketing and branding support. Convergence is being sought with the existing ecosystem to support and complement other schemes such as the National Rural Livelihood Mission, National Urban Livelihood Mission, One District One Product, AIF, and PMKSY implementation.

Talking on food management and social net for food security, the report says the main objectives of food management are the procurement of foodgrains from farmers at remunerative prices, the distribution of foodgrains to consumers, particularly to the vulnerable sections of society, at affordable prices, and the maintenance of food buffer stocks for food security and price stability.

Way forward

In its concluding remarks, the report says the performance of the agriculture sector remains critical for the economy’s growth and has been growing at an average growth rate of 4.18% over the last five years. The growing significance of allied sectors such as animal husbandry, dairying, and fisheries in enhancing farmers’ income suggests that greater emphasis should be placed on tapping into the potential of these activities to boost farmers’ incomes.

“Smallholder farmers’ incomes cannot be increased by producing rice, wheat, or even millets, pulses and oilseeds. They need to move to high-value agriculture – fruits and vegetables, fisheries, poultry, dairy and buffalo meat. Once the incomes of smallholders increase, they will demand manufactured goods, spurring a manufacturing revolution. That is what happened in China between 1978 and 1984 when the real incomes of farmers doubled in just 6 years. India is well-placed to emulate this,” it says.

Efforts must be made to encourage production patterns and practices in various geographies that are consistent with their agro-climatic characteristics and natural resources. Research and development and promotion of digital technologies in agriculture, as well as improving the quality of seeds, including promoting organic and natural farming, can play a significant role in the realization of sustainable agriculture practices that improve farm income and influence farmer behavior, the survey says.

According to the survey, enhancing private sector investment in agriculture is vital to provide impetus to the agriculture sector. Investment in technology, production methods, marketing infrastructure, and reduction in post-harvest losses need to be scaled up. A greater focus on post-harvest infrastructure and the development of the food processing sector can reduce wastage/loss and increase the length of storage, ensuring better prices for the farmers. Productivity of the crop sector can also be enhanced through greater investment, including from the private sector.

The fact that food processing is a sunrise sector and holds immense potential has been validated by various reports by private industry bodies in the past. The PHD Chamber of Commerce and Industry in a report this year has anticipated that India’s food processing sector is likely to reach US$ 700 billion by FY2030.

However, what is needed is a bigger push, more investment and in-depth research and development to take it to greater heights. In a previous issue, we quoted a report by consultancy firm Grant Thornton Bharat that said the contribution of India’s food processing sector to the country’s GVA needs to quadruple to 7.2% from the existing just 1.8% if the nation aspires to become a developed country by 2047. It says significant investment is needed in rural infrastructure such as grading and packing centers, storage facilities, transportation, and testing laboratories to aid the food processing industry.

IndiFoodBev — authentic, impactful and influential

An English-language food and beverage processing and packaging industry B2B platform in print and web, IndiFoodBev is in its third year of publication. It is said that the Indian food and beverage industries represent approximately US$ 900 billion in revenues which implies more than 20% of the country’s GDP. Eliminating the wastage on the farmside can help to deliver more protein to a higher number of the population apart from generating sizable exports. The savings in soil, seeds, water, fertilizer, energy and ultimately food and nutrition could be the most immense contribution that country is poised to make to the moderation of climate change.

To improve your marketing and grow sales to the food and beverage processing and packaging industry, talk to us. Our research and consulting company IppStar [www.ippstar.org] can assess your potential and addressable markets in light of the competition. We can discuss marketing, communication, and sales strategies for market entry and growth.

Suppliers and service providers with a strategy and budget for targeted marketing can discuss using our hybrid print, web, video, and social media channels to create brand recognition linked to market relevance. Our technical writers are ready to meet you and your customers for content.

The second largest producer of fruit and vegetables in the world is continuously expanding processing capacities and delivery systems with appropriate innovative technologies. We cover product and consumer trends, nutrition, processing, research, equipment and packaging from farm to thali. Get our 2025 media kit and recalibrate your role in this dynamic market. Enhance your visibility and relevance to existing markets and turn potential customers into conversations. Ask for a sample copy of our bi-monthly in print or our weekly IndiFoodBev eZine each Wednesday.

For editorial info@ippgroup.in — for advertisement ads1@ippgroup.in and for subscriptions subscription@ippgroup.in

Naresh Khanna – 10 February 2025

Subscribe Now