The spice industry of India – known for millennia as a global resource – is hotting up both in terms of production and exports with the sector contributing approximately 9% to India’s total agricultural exports and over 40% of its horticultural exports, according to government data.

Of the 109 spices recognized by the International Organization for Standardization, India, known for its rich agricultural and culinary heritage, cultivates over 60 varieties and exports more than 225 unique products to almost every country in the world, reinforcing its position as a trusted global supplier of both raw and value-added spices.

There are various estimates of India’s spice industry and market size, which include branded mega and medium as well as small non-branded players. According to IMARC, India’s spices market size reached Rs 200,643.7 crore (approximately US$ 22.89 billion) in 2024 and is expected to reach Rs 513,253.9 crore (approximately US$ 58.57 billion) by 2033, at a CAGR of 10.56% in this period.

Some of the major drivers are a rising global and domestic demand in the food and beverage sector, adoption of spices for medicinal purposes, increasing consumer preference for organic and specialty spices, and government support for the promotion of spice cultivation, sustainable sourcing, and innovation. An additional driver is the introduction of new blends, along with advancements in processing and packaging.

Largest exporter of spices

According to government data, India was the largest global exporter of spices and products, with exports reaching US$ 4.45 billion (approximately Rs 38,992 crore) in FY 2024-25, nearly a quarter of the global market valued at US$ 20 billion (Rs 175,025 crore).

The top 10 destinations were China, the US, the UAE, Bangladesh, Thailand, Malaysia, the UK, Saudi Arabia, Indonesia, and Germany. Collectively, these markets accounted for over 60% of total spice export earnings in FY 2024-25 (till February 2025).

The US was one of the largest markets for Indian spices, importing products such as celery, cumin, curry powder, fennel, fenugreek, garlic, chili, and mint products. Exports of spices and spice products to the US in value terms stood at US $711 million (Rs 6,252 crore) during 2024-25, up 15% from the previous year’s $619.29 million (₹5429 crore). Indian spice exporters, however, are in a fix after Donald Trump’s tariff order, fearing loss of market in the US to ASEAN competitors in some categories such as pepper, turmeric, and ginger.

Between 2013-14 and 2024-25, spice exports increased by 88% in volume and 97% in value (US$). Gujarat led with 23.53% of the total exports, followed by Kerala and Andhra Pradesh. In 2013-14, spice exports were recorded at 817,250 metric tons (MT), valued at US$ 2.27 billion (Rs 19,848.47 crore approx), showcasing significant growth over the years, according to government data.

Chili led the chart with a total export value of US$ 1.5 billion (Rs 12,450 crore) in FY2023-24, followed by cumin and spice oils and oleoresins, with export values of US$ 700.23 million (Rs 612.91 crore) and US$ 498.01 million (Rs 43.60 crore), respectively. Other products included mint products, turmeric, and curry powders and paste.

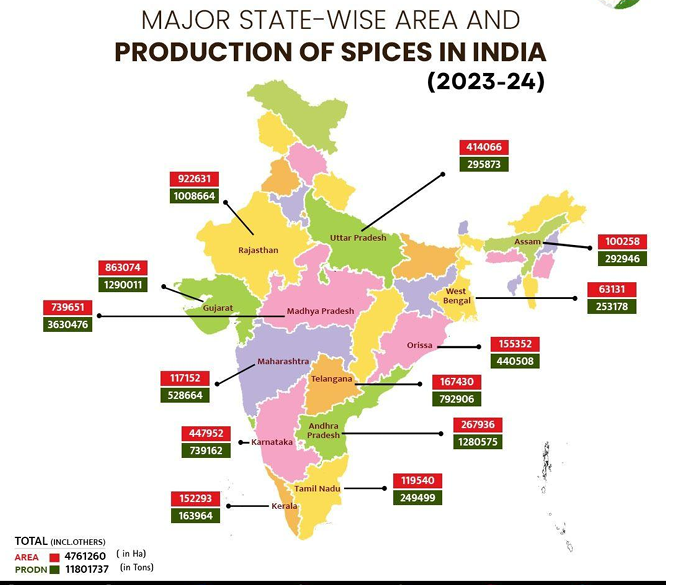

In 2023-24, Madhya Pradesh led India’s spice production with 3.63 million tons, followed by Gujarat with 1.29 million tons and Andhra Pradesh with 1.28 million tons. Rajasthan and Telangana also made significant contributions, producing over 1 million tons and 793,000 tons, respectively. These top five states play a crucial role in maintaining India’s leadership in the global spice market.

Other major spice growing states are Uttar Pradesh (295,873 tons), West Bengal (253,178 tons), Assam (292,946 tons), Orissa (440,508 tons), Tamil Nadu (249,499 tons), Kerala (163,964 tons), Karnataka (739,162) and Maharashtra (528,664 tons).

In FY24, India produced an estimated 12 million metric tons of spices. In FY23, the number stood at 11.14 million tons and 11.12 million tons in FY22, according to the Spices Board of India and the Directorate General of Commercial Intelligence and Statistics data. In FY 17, India produced 10.42 million metric tons of spices, which went down to 9.21 million tons in FY 19, but later recovered.

Leading spice players

Leading players in the market include Aachi Spices & Foods, Badshah Masala, Eastern Condiments, Everest Food Products, Mahashian Di Hatti (MDH), MTR Foods, Patanjali Ayurved, Dabur India, DS Group (Catch), Pushp Brand (India), Ushodaya Enterprises (Priya), Shubham Goldiee Masale, ITC Sunrise, and Tata Sapmann.

They produce a host of pure spices such as chilli, turmeric, coriander, cumin, pepper, tamarind, asafetida, bay leaf, clove, cardamom, cinnamon as well as blended spices such as garam masala, non-veg masala, kitchen king and sabzi masala, chole and channa masala, chat masala, sambhar and rasham masala, paneer and curry masala, pav bhaji masala, and jaljeera masala.

A report by Coherent Market Insights states that competitive strategies from these players underscore a strong emphasis on product innovation and expanding distribution networks. For instance, Everest Food Products invested in state-of-the-art spice extraction technologies in 2024, which resulted in a 10% increase in market share within premium spice segments.

Similarly, Dabur India’s strategic focus on organic spice variants and eCommerce penetration drove a 15% uplift in market revenue. These business growth tactics highlight the evolving strategies geared towards consolidating industry size and enhancing market positioning, the report says.

Goldiee, on the other hand, with a distribution reach of over 2 lakh retail outlets and 2,000 plus distributors across India, as well as leading eCommerce players and quick delivery apps, has extended its reach across India and is growing its footprint in the international markets. The company also commissioned one of the largest automated spice production plants in Kanpur in 2024.’

Nagging issues

Although the sector has immense potential, experts flag a few problem points too. India leads in spice production, but the bulk of it (around 85%) is consumed domestically. More than half of the exports are raw and whole spices, rather than value-added products such as seasonings.

Experts feel the market needs more focus on processed products and seasonings to achieve the US$ 10 billion export goal by 2030, by taking the share of value-added products to 70% and to meet rising competition from countries such as Vietnam, Indonesia, China, and a few African nations.

Other issues that need attention are high production costs, outdated agricultural practices, the need to modernize processing, a reduction in the use of pesticides to check rejections over contamination, and better hygiene standards to meet global regulations. Climate change has also had an impact on spice crops, as changing monsoon patterns, extreme weather and rising temperatures affect yield and quality.

The government has, however, launched quite a few initiatives to enhance production. The Spices Board of India works to develop, promote, and regulate the export of 52 spices and spice products in order to make India an international processing hub and a premier supplier of clean, safe, and value-added spices and spice products.

The board has established eight crop-specific spice parks across India to enhance spice processing, value addition, and export opportunities. These parks provide common facilities for cleaning, sorting, grading, grinding, oil extraction, and packaging of spices, benefiting local farmers, traders, exporters, and other stakeholders.

These are Chhindwara for garlic and chilli and Guna (both Madhya Pradesh) for coriander, Guntur in Andhra Pradesh for chillies, Jodhpur for cumin and Ramganjmandi (both Rajasthan) for coriander, Puttady in Kerala for cardamom and pepper; Raebareli in Uttar Pradesh for Mint; and Sivaganga in Tamil Nadu for chillies and turmeric.

IndiFoodBev — authentic, impactful and influential

An English-language food and beverage processing and packaging industry B2B platform in print and web, IndiFoodBev is in its third year of publication. It is said that the Indian food and beverage industries represent approximately US$ 900 billion in revenues which implies more than 20% of the country’s GDP. Eliminating the wastage on the farmside can help to deliver more protein to a higher number of the population apart from generating sizable exports. The savings in soil, seeds, water, fertilizer, energy and ultimately food and nutrition could be the most immense contribution that country is poised to make to the moderation of climate change.

To improve your marketing and grow sales to the food and beverage processing and packaging industry, talk to us. Our research and consulting company IppStar [www.ippstar.org] can assess your potential and addressable markets in light of the competition. We can discuss marketing, communication, and sales strategies for market entry and growth.

Suppliers and service providers with a strategy and budget for targeted marketing can discuss using our hybrid print, web, video, and social media channels to create brand recognition linked to market relevance. Our technical writers are ready to meet you and your customers for content.

The second largest producer of fruit and vegetables in the world is continuously expanding processing capacities and delivery systems with appropriate innovative technologies. We cover product and consumer trends, nutrition, processing, research, equipment and packaging from farm to thali. Get our 2025 media kit and recalibrate your role in this dynamic market. Enhance your visibility and relevance to existing markets and turn potential customers into conversations. Ask for a sample copy of our bi-monthly in print or our weekly IndiFoodBev eZine each Wednesday.

For editorial info@ippgroup.in — for advertisement ads1@ippgroup.in and for subscriptions subscription@ippgroup.in

Naresh Khanna – 10 February 2025

Subscribe Now