Rising domestic consumption backed by the strong economy has contributed to the growth of the Japanese dairy and soy food sector. This sector is forecast to grow from JPY 2,084.8 billion or US$18.7 billion (approximately Rs 1.3 lakh crore) in 2018 to JPY 2,396.6 billion or US$ 23.1 billion (approximately Rs 1.64 lakh crore) by 2023, at a compound annual growth rate (CAGR) of 2.8%, says GlobalData.

GlobalData’s report on ‘Japan Dairy & Soy Food – Market Assessment and Forecast to 2023’, reveals that cheese was the largest category with value sales of JPY 513.3 billion or the US $ 4.6 billion (approximately Rs 33,000 crore) in 2018. The category is also forecast to register the fastest value growth at a CAGR of 4.3% from 2018 to 2023, followed by yogurt 3.9%.

Sneha Singh, consumer analyst at GlobalData, says, “With increasing disposable income, consumers are looking for more nutritious dairy & soy food products. The demand is likely to grow further, fueled by the growing Japanese economy.”

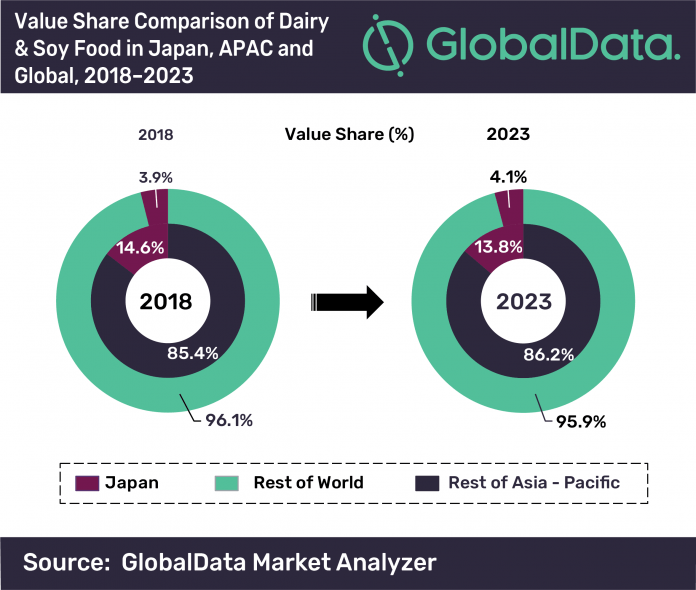

The value share of Japan in the global dairy and soy food sector is expected to increase from 3.9% in 2018 to 4.1% by 2023. However, the country’s share at a regional level is expected to decrease marginally by 0.8% during the next five years.

The report also states that Meiji Holdings, Megmilk Snow Brand, and Morinaga Milk Industry are the leading market players in the Japanese dairy and soy food sector. These top three companies offer products in the butter and spreadable fats, cheese, cream, dairy-based and soy-based desserts, drinkable yogurt, milk, and yogurt categories.

Private label penetration remained low in the Japanese dairy and soy food sector at 2.6% in 2018. However, private label products are growing at a higher CAGR than branded products.

Singh concludes, “‘Naturally healthy and ‘free-from’ are forecast to remain the key health and wellness attributes in the next five years, as consumer demand for ‘all-natural’ and ‘fat-free’ dairy products continue to grow in the Japanese dairy and soy food sector.”

IndiFoodBev — authentic, impactful and influential

An English-language food and beverage processing and packaging industry B2B platform in print and web, IndiFoodBev is in its third year of publication. It is said that the Indian food and beverage industries represent approximately US$ 900 billion in revenues which implies more than 20% of the country’s GDP. Eliminating the wastage on the farmside can help to deliver more protein to a higher number of the population apart from generating sizable exports. The savings in soil, seeds, water, fertilizer, energy and ultimately food and nutrition could be the most immense contribution that country is poised to make to the moderation of climate change.

To improve your marketing and grow sales to the food and beverage processing and packaging industry, talk to us. Our research and consulting company IppStar [www.ippstar.org] can assess your potential and addressable markets in light of the competition. We can discuss marketing, communication, and sales strategies for market entry and growth.

Suppliers and service providers with a strategy and budget for targeted marketing can discuss using our hybrid print, web, video, and social media channels to create brand recognition linked to market relevance. Our technical writers are ready to meet you and your customers for content.

The second largest producer of fruit and vegetables in the world is continuously expanding processing capacities and delivery systems with appropriate innovative technologies. We cover product and consumer trends, nutrition, processing, research, equipment and packaging from farm to thali. Get our 2025 media kit and recalibrate your role in this dynamic market. Enhance your visibility and relevance to existing markets and turn potential customers into conversations. Ask for a sample copy of our bi-monthly in print or our weekly IndiFoodBev eZine each Wednesday.

For editorial info@ippgroup.in — for advertisement ads1@ippgroup.in and for subscriptions subscription@ippgroup.in

Naresh Khanna – 10 February 2025

Subscribe Now