By – Dr Mukti Sudan Basu

The presence of aflatoxin in food is recognized as one of the biggest threats to access to safe food and ultimately affecting food exports. Aflatoxin, a secondary metabolite of Aspergillus flavus and A. parasiticus, is highly carcinogenic. Crops such as groundnut, maize, millets, chili, and many others are easily contaminated by aflatoxin.

Aflatoxin contamination happens both at pre and post-harvest stages. Aflatoxin content in the fresh harvest in high-risk areas may go beyond 50 parts per billion (ppb) and moves up rapidly along with the length of storage (>100 ppb). The contamination has a severe impact on human health since aflatoxin is carcinogenic as well as immuno-suppressive in nature. In India, although the safe level of aflatoxin is kept at 30 ppb, the European standard is more stringent at two ppb, whereas it varies between 5 to 15 ppb in most of the developed countries.

Export challenges

According to reports, groundnut exports to EU countries from India have almost come to a halt due to aflatoxin contamination of groundnut and groundnut products. Though the volume of groundnut export has increased, these are confined to South-east Asian countries (76%) and mostly as bird-feed, in recent years. Paradoxically, India has the world’s largest area under groundnut cultivation and is the second-largest producer, next to China. Our exports are in stark contrast with countries such as Argentina, which export 73% of their produce to EU countries. The present situation is neither benefiting the country nor the farmers associated with its cultivation.

The only existing export of Indian groundnut to the West is to the USA, not raw in the form of kernel or grain, but as value-added products under confectionery categories. However, there are just a handful of significant export players in a big country like India! Of late, trouble started brewing, and there have been quite a few import alerts regarding Indian groundnut products arriving at US ports. These have adverse consequences, which may lead to a total ban on Indian products leading to considerable monetary losses and the loss of face for the exporting companies, and ultimately, the country.

Imported food products are subject to inspection by the Food and Drug Administration (FDA) at US ports of entry. The FDA may detain shipments of products if they do not fulfill US standards. The FDA maintains a list of import alerts to inform the FDA field staff, and the US public, that the agency has enough evidence to allow for Detention Without Physical Examination (DWPE) of products that appear to violate US laws and regulations. These violations could be related to the product, manufacturer, shipper, or other factors. When a product or firm is violative in meeting the criteria as indicated in an import alert, it will be added to the red list or removed from the green list of the alert.

Intervention in the value chain

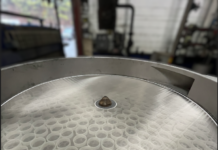

Five villages in Anantapur district (Andhra Pradesh) were adopted under a special project supported by the United Nations Development Programme to address the aflatoxin issue. These villages were identified based on the severity of the problem. During the project, the critical factors responsible for aflatoxin contamination at farm and storage levels were identified. Moreover, by integrating a couple of key management factors at the pre- and post-harvest levels, it was possible to demonstrate negligible aflatoxin contamination (0 to 5 ppb) in these high-risk areas even after 3 to 6 months of ordinary storage at the household level. In 75% of the cases, the aflatoxin contamination levels were <15 ppb.

Dr Mukti Sudan Basu is managing director of SBSF consultancy. He is formerly, director of ICAR, Visiting Scientist ICRISAT, and UNIDO International Consultant on Aflatoxin in Africa.

IndiFoodBev — authentic, impactful and influential

An English-language food and beverage processing and packaging industry B2B platform in print and web, IndiFoodBev is in its third year of publication. It is said that the Indian food and beverage industries represent approximately US$ 900 billion in revenues which implies more than 20% of the country’s GDP. Eliminating the wastage on the farmside can help to deliver more protein to a higher number of the population apart from generating sizable exports. The savings in soil, seeds, water, fertilizer, energy and ultimately food and nutrition could be the most immense contribution that country is poised to make to the moderation of climate change.

To improve your marketing and grow sales to the food and beverage processing and packaging industry, talk to us. Our research and consulting company IppStar [www.ippstar.org] can assess your potential and addressable markets in light of the competition. We can discuss marketing, communication, and sales strategies for market entry and growth.

Suppliers and service providers with a strategy and budget for targeted marketing can discuss using our hybrid print, web, video, and social media channels to create brand recognition linked to market relevance. Our technical writers are ready to meet you and your customers for content.

The second largest producer of fruit and vegetables in the world is continuously expanding processing capacities and delivery systems with appropriate innovative technologies. We cover product and consumer trends, nutrition, processing, research, equipment and packaging from farm to thali. Get our 2025 media kit and recalibrate your role in this dynamic market. Enhance your visibility and relevance to existing markets and turn potential customers into conversations. Ask for a sample copy of our bi-monthly in print or our weekly IndiFoodBev eZine each Wednesday.

For editorial info@ippgroup.in — for advertisement ads1@ippgroup.in and for subscriptions subscription@ippgroup.in

Naresh Khanna – 10 February 2025

Subscribe Now